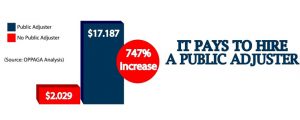

When Should I Hire a Public Adjuster?

Article by Neal Mcloughlin

The best time to seek assistance from a Public Adjuster is at the very start of the claim. Even before the claim is made you may want a free inspection, a no obligation review of the damage to your property to ensure that you actually have a valid claim. Many times, homeowners and property owner do not fully understand their policy. And they can mistakenly make a claim that will either not be paid and denied outright, or they will not meet their deductible and therefore receive no monetary compensation for the loss. Continue reading “When Should I Hire a Public Adjuster?”