How to select a Qualified Appraiser?

Article by Neal Mcloughlin

Well obviously, choose me!

But lets just for argument say I am busy and you need to select proper representation in Appraisal. Here is what you should look for.

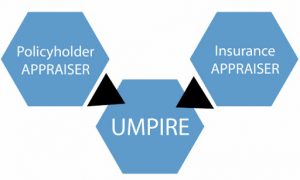

We all know or should at this point if you have been reading my blog. As one source put me to sleep with “The insurance appraisal process for property claims can be an effective and efficient way for insurance claim disputes to be settled. Choosing an unbiased independent appraiser to represent your claim will be the most important choice during the appraisal process. Your selection should be strategically and carefully considered because it could mean the difference between having enough money to rebuild and restore your property, or not. ” Thanks C3, actually good guys.

OK, wake up time. We get it if you pick the wrong Appraiser, you just flushed your money and more important time down the drain. But on the upside, you gave some money to an unemployed public adjuster who was a friend of your adjuster. That’s something, I guess if you are into charity.

First ask for references from contractors who have actually used this Appraiser. As an example, I provide a list of recent clients to my prospective clients and Yes, I expect them to call them. I also list the docket numbers of the cases in which I was selected by a sitting judge who made the determination that I am the most qualified of all submitted candidates, and or a subject matter expert in the field of dispute. Everything is open if you just look it up.

I also have an updated resume with my education. Bachelor’s degree, Master’s degree, and yes I am finishing my Doctorate degree. No, you do not have to call me Dr Neal, not yet anyway. Any IICRC certifications and other association affiliations NSPII etc. Now after all that I decide if I want you as a client. Yes, that’s right kind of unusual from the sharks who will take any and all Appraisal cases no matter what, most of them without asking any question. That’s not a big RED flag..

I will for no coast review your submitted Appraisal estimate and compare it to the carrier’s estimate and give you feedback on whether or not this is A.) Ripe for Appraisal (see the other blog post on “Ripe for Appraisal” ) and B.) If this is a reasonable spread (difference in pricing) to warrant going to Appraisal. I have seen unscrupulous Appraisers out there who take on Appraisals knowing full well that even if they win they lose.

There is no making a point in the insurance restoration business. There is no I proved my point. No one cares. The bottom line is answering this one question. Is there any value in going to Appraisal? and that is what I determine before accepting an Appraisal assignment.

Till then be safe and be happy remember “We are here for a good time not for a long time”

Neal McLoughlin

About the author Mr. Neal McLoughlin is a licensed Public Adjuster in multiple states and has handled claims for over 20 years. He holds several professional designations and certifications from a variety of professional organizations. He is the founder of Property Claims Loss and sits on the Executive Board of the Appraisal and Umpire Association. He can be reached at (773) 497-2856 or via email at LossAssist@gmail.com or Neal@PropertyClaimsLoss.com

References